Managing payroll for large enterprises is a task that involves navigating complex regulations, handling multiple jurisdictions, ensuring compliance, and improving operational efficiency. For businesses with a global workforce, the intricacies of payroll become even more complicated.

With the rise of Global Payroll Solutions, companies now have the tools to streamline these processes, reduce costs, and ensure compliance while improving Payroll Efficiency. By integrating Payroll Technology, businesses can turn payroll from a cumbersome task into a strategic asset.

In this article, we’ll dive deep into how adopting HR Technology and leveraging Automated Payroll Services can help large enterprises tackle Complex Payroll Challenges, reduce costs, and optimize payroll operations.

The Complexity of Global Payroll in Large Enterprises

Employees work across multiple countries with tax laws, employment regulations, and currencies. These diverse needs create challenges in processing payroll on time and complying with local laws.

For example, what happens when a company employs workers in the U.S. and Japan? The payroll team must calculate different tax rates, comply with both countries’ labor laws, and make payments in the appropriate currencies. These challenges create significant Complex Payroll Challenges.

Some of the common issues faced by organizations dealing with Multijurisdictional Payroll include.

- Varying tax and wage structures: Different countries have different tax brackets, social security contributions, and minimum wage regulations, which require businesses to ensure payroll accuracy across multiple regions.

- Payroll Compliance: With each jurisdiction having its compliance requirements, such as statutory deductions and labor laws, it is easy to make errors in payroll processing. Non-compliance can lead to costly fines and reputational damage.

- Cultural and legal differences: Global businesses must be aware of regional customs related to pay and benefits, ensuring payroll systems reflect local employment practices, holidays, and leave policies.

For a deeper understanding of the differences and responsibilities of the payroll function in HR, check out this detailed blog to see how integrating payroll with HR functions can further enhance efficiency.

Download our comprehensive eBook on mastering global payroll processes today! Gain valuable insights into solving your Complex Payroll Challenges and create a unified, efficient payroll system for your global workforce.

Unlocking the Power of Payroll Technology

Payroll Technology has revolutionized how payroll is processed for large enterprises. Instead of relying on outdated manual processes, businesses can now access cutting-edge payroll systems that automate payroll calculation, distribution, compliance tracking, and reporting. The most significant benefit of leveraging payroll technology is improving Payroll Efficiency.

Here’s how Payroll Technology can address the challenges faced by businesses:

- Automation: Automating payroll tasks such as tax calculation, wage calculation, and deductions ensures fewer errors and saves time. Automation is one of the core features of Automated Payroll Services that helps businesses stay compliant across various jurisdictions while speeding up payroll cycles.

- Real-Time Payroll Processing: This ensures payroll is completed swiftly, with any discrepancies identified and resolved instantly. This increases efficiency, reduces delays in pay processing, and improves employee satisfaction.

- Reduced manual errors: When payroll is automated, human error is reduced, leading to more accurate and timely payroll. This ensures that employees are paid correctly and reduces the risk of costly compliance issues.

With the right Global Payroll Solutions, businesses can streamline their payroll processes, save time, and reduce the operational burden of managing payroll across multiple regions.

Effective Payroll Event Management is crucial in ensuring timely and accurate payroll execution. For more insights on optimizing payroll events, check out this helpful resource on payroll event management tips for HR professionals.

Download the eBook Now to get started on streamlining your global payroll process!

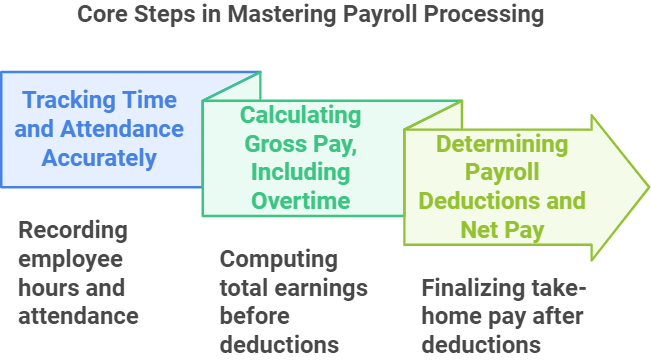

Core Steps in Mastering Payroll Processing

Mastering payroll processing requires a meticulous approach to ensure accuracy, compliance, and efficiency. However, understanding and implementing the core steps in payroll processing is essential for ensuring Payroll Efficiency and achieving smooth operations. Let’s break down the key steps involved in mastering payroll processing.

1. Tracking Time and Attendance Accurately

Accurate time and attendance tracking is the foundation of every payroll process. The payroll system cannot produce accurate paychecks without precise data on hours worked, overtime, sick leave, or vacation days.

- Manual Timesheets: Employees fill out timesheets detailing the hours they have worked. While this method can be effective for small teams, it often leaves room for errors or manipulation.

- Time Clocks and Biometric Systems: Larger enterprises often use automated time clocks or biometric systems (such as fingerprint scans) to record working hours. These systems reduce errors, prevent time theft, and provide more reliable data.

- Time and Attendance Software: Many companies now use cloud-based HR Technology or dedicated time and attendance software that integrates seamlessly with payroll systems. These systems automatically track hours worked, considering employee shifts, breaks, and overtime hours.

Accurate timekeeping ensures that employees are paid correctly and contributes to the overall Payroll Compliance, as it provides clear documentation in case of audits. Inaccurate or incomplete data can lead to payroll errors and, in some cases, costly compliance violations.

2. Calculating Gross Pay, Including Overtime

Once the time and attendance data is accurately recorded, the next critical step is calculating the gross pay, which represents the total amount an employee earns before any deductions. Gross pay includes regular wages, overtime, bonuses, and commissions, varying depending on an employee’s role, working hours, and contractual terms.

Calculating gross pay becomes increasingly complex for large enterprises with a global workforce.

- Base Salary or Hourly Rate: This is the foundation of an employee’s pay. Whether an employee is salaried or paid hourly, this is the starting point for gross pay calculations.

- Overtime: Overtime pay is typically calculated based on a rate higher than the regular hourly wage, usually 1.5 times the standard hourly rate (though it varies by jurisdiction). Large enterprises operating in multiple regions must ensure they comply with local labor laws regarding overtime. For example, while the U.S. requires overtime to be paid for any hours worked over 40 per week, countries like the UK or Germany may have different rules about overtime thresholds.

According to Fit Small Business the percentage of workers living paycheck to paycheck has risen from 58% in 2023 to 65% in 2024.

- Commissions and Bonuses: Many employees, especially in sales or customer-facing roles, are entitled to commissions or performance-based bonuses. These amounts must be calculated and added to the gross pay.

- Shift Differential Pay: Sometimes, employees may be paid extra for working night shifts or weekends. This additional pay must be included when calculating gross pay.

- Holiday Pay: In certain regions, employees are entitled to extra pay for working on public holidays. If an employee works on a holiday, this should be included in the calculation of their gross pay.

Accurate gross pay calculation is crucial not only for employee satisfaction but also for compliance with labor laws. A mistake here can result in underpaying or overpaying employees, which could create issues for Payroll Compliance and affect overall Payroll Operations Optimization.

3. Determining Payroll Deductions and Net Pay

After calculating the gross pay, the next step is to determine the various payroll deductions that need to be applied before arriving at the net pay, which is the amount that employees take home. Payroll deductions typically fall into two categories: mandatory deductions and voluntary deductions.

- Mandatory Deductions: These are deductions that are required by law, such as:

- Taxes: Income tax, social security contributions, unemployment taxes, and other regional-specific taxes (e.g., in the UK, the National Insurance contribution is mandatory).

- Retirement Contributions: Employees must contribute to state-run pension systems or other retirement plans in many countries.

- Health Insurance: Mandatory public or private healthcare deductions may apply depending on the country.

- Union Dues: If an employee is a union member, union dues may be automatically deducted.

- Voluntary Deductions: These are deductions that employees opt into, such as:

- Health Insurance Premiums: If an employee chooses a private health insurance plan or supplementary coverage, their portion of the premium will be deducted from their paycheck.

- Retirement Contributions: Employees may choose to contribute to additional retirement savings, such as a 401(k) plan in the U.S.

- Charitable Donations: Employees may choose to have a portion of their paycheck donated to charity.

- Other Benefits: Voluntary deductions could include flexible spending accounts (FSAs), employee stock purchase programs, and loan repayments.

It’s essential to ensure compliance with local Payroll Compliance regulations, as failure to do so could lead to penalties or legal action. Moreover, ensuring that Payroll Data Management is handled efficiently can help companies avoid discrepancies and make all deductions accurately.

To simplify the complexities of payroll processing and ensure accuracy across regions, download our eBook today. Learn how to streamline payroll management and stay compliant with local regulations.

The Importance of Streamlined Payroll Processes

Streamlined Payroll Processes are critical for ensuring payroll is managed effectively and on time without requiring a disproportionate amount of administrative work.

A Unified Payroll System integrates payroll data with HR and finance systems, ensuring payroll runs smoothly without duplication or data entry errors. This system ensures that all employee data, including tax information, benefits, and working hours, is easily accessible and integrated into a single source of truth, reducing discrepancies across systems.

- Payroll Data Management is essential in ensuring that the payroll system is streamlined and compliant.

- By centralizing all payroll data in a secure, accessible database, payroll teams can quickly retrieve the necessary information to address any payroll discrepancies.

- Payroll teams can also review historical data and ensure compliance with local tax and labor laws, minimizing errors and delays.

HR and Payroll Integration: The Backbone of Efficient Payroll

HR and Payroll Integration is an essential part of modern payroll management. When HR and payroll systems are interconnected, data flows seamlessly between departments, reducing the need for manual input and preventing errors. This integration can be beneficial when managing global payroll, ensuring that payroll and HR systems are synchronized across multiple regions.

By integrating HR Technology with payroll systems, businesses can achieve a more holistic approach to workforce management, improving accuracy, compliance, and overall efficiency.

For example, when an employee’s HR profile is updated with new tax information or benefits enrollment, the changes automatically sync with the payroll system, ensuring that the right deductions are made and the employee’s pay is calculated correctly.

Additionally, integrating HR and payroll systems ensures businesses can easily track employee hours, commissions, and overtime across multiple jurisdictions. This is especially useful for companies that employ a global or hybrid workforce.

Businesses can enhance efficiency and compliance across regions by leveraging the benefits and methods to integrate HR and payroll systems.

Download the eBook Now for a complete guide on mastering payroll processing and ensuring smooth, accurate payroll operations!

Reducing Payroll Costs Through Automation

One of the most significant advantages of Automated Payroll Services is the ability to reduce payroll costs. Automation allows businesses to significantly cut back on administrative overhead by eliminating repetitive manual tasks that previously required human intervention.

A recent annual survey by ZipRecruiter revealed that employers face increasing pressure from candidates to raise salaries. According to the study, 41% of employers reported that positions remained unfilled in the past six months because candidates demanded higher compensation than the company offered.

Here’s how automation can help achieve Payroll Cost Reduction:

- Fewer Payroll Errors: Since the system automatically calculates tax deductions, benefits, and salaries, the chances of errors are significantly reduced. This results in fewer corrections and less time spent on troubleshooting payroll issues.

- Time Savings: Automation speeds up payroll processes, reducing the time dedicated to payroll administration. This frees payroll teams to focus on strategic tasks rather than data entry and calculations.

- Improved Compliance: By automating compliance tracking and reporting, businesses reduce the risk of incurring penalties due to missed deadlines or incorrect reporting, which can otherwise add significant costs.

By reducing the time spent on manual payroll activities and eliminating errors, businesses can reallocate resources to other vital areas, further reducing operational costs.

Payroll Operations Optimization: Unlocking Efficiency

Payroll Operations Optimization is all about improving the efficiency and effectiveness of payroll tasks while reducing the workload on payroll teams. Optimization involves identifying bottlenecks in the payroll process and implementing solutions that streamline the workflow.

- Leveraging Cloud-Based Payroll Solutions: Cloud-based payroll systems provide flexibility and scalability, allowing businesses to manage payroll across multiple jurisdictions without worrying about on-premise infrastructure. This scalability is vital for companies as they grow.

- Self-Service Portals for Employees: Implementing self-service portals enables employees to access their pay information, request time off, and review their benefits without contacting HR or payroll teams. This reduces the burden on payroll departments and increases employee engagement.

- Automated Tax Updates: Automated updates to tax laws ensure that businesses always comply with the latest regulations, reducing the risk of errors and compliance issues.

Large enterprises can significantly improve payroll turnaround times, reduce costs, and improve the overall employee experience by optimizing payroll operations.

The Road Ahead: Future-Proofing Your Payroll System

As businesses expand globally, the need for a robust, integrated payroll system will only grow. Global Payroll Solutions offers companies the tools to manage payroll effectively across multiple jurisdictions, ensuring compliance, increasing Payroll Efficiency, and reducing costs. With HR Technology and Automated Payroll Services, companies can address the Complex Payroll Challenges they face as they scale, ensuring that payroll is processed quickly, accurately, and in compliance with local and international laws.

By integrating HR and Payroll Integration into a Unified Payroll System, businesses can streamline their payroll operations, improve employee satisfaction, and reduce administrative overhead. Adopting the latest Payroll Technology is essential for long-term success, whether you’re managing payroll for a global workforce or a local team.

Want to dive deeper into optimizing your payroll system? Download our free eBook, Master Payroll Like Never Before, to discover how you can streamline payroll, reduce costs, and improve Payroll Efficiency across your enterprise.

Get your free eBook now and start mastering payroll like never before!

Conclusion

Global Payroll Solutions can potentially transform payroll for large enterprises. From Multijurisdictional Payroll to Real-Time Payroll Processing, modern payroll technology allows businesses to streamline their operations, reduce costs, and ensure compliance across multiple regions. By adopting and integrating Payroll Technology with HR Technology, businesses can unlock new efficiencies, improve accuracy, and future-proof their payroll systems.

Don’t let payroll challenges slow your business down. By embracing the right solutions, you can unlock the full potential of your payroll operations and set your business up for success in an increasingly globalized world.

Download our eBook now and take the first step toward mastering your payroll systems today!